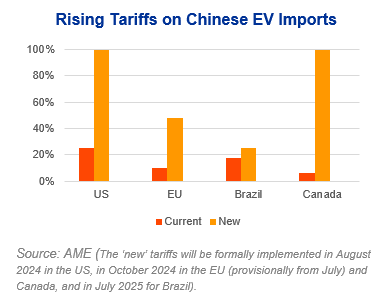

China’s efforts to prop up growth on the back of new technology exports, such as EVs, is increasingly putting it at odds with its key trading partners. The US, Canada, the EU, Brazil, India and Turkey have been raising tariffs or imposing new ones on low-cost Chinese EV imports that threaten to overwhelm local industries.

The

last few years have seen growing political appetite for interventionist

industrial policy in a shift away from free market policies. We expect a more

protectionist trade environment in the medium-term as countries look to

safeguard costly re-industrialisation strategies.

China’s

EV exports rose 11.4% on-year to 708k in January-July, easing from last year’s

64% surge to 1.5m, on the back of growing resistance from Europe, as well as

cooler demand growth. China exported almost 10% (9.6GWh) of its battery

production in July, up from around 12% in 2023.

Chinese

OEMs are investing in building factories in key markets, namely the EU, or in

those that offer an alternative supply chain route to key markets, such as

Morocco. Rerouting products through third countries is another likely outcome. Chinese

automakers are also looking to diversify their export markets. BYD’s top export

markets now include Brazil, Thailand, Israel, Australia and Malaysia.