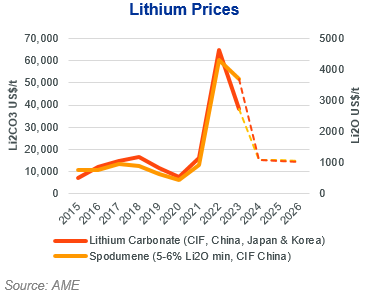

Between 2021 and 2022, the lithium boom was showing no signs of relenting and producers clambered to get new lithium mines into production to meet demand. However, new supply and a weaker than anticipated demand from EVs, soon led to a huge decline in the lithium price.

We estimate the spodumene price (5-6% Li2O min, CIF China) will drop 75% from its yearly high of US$4,300/t in 2022 to average US$1,067/t this year. Similarly, we expect the lithium carbonate price (CIF China, Japan & Korea) will see a 78% decline from US$64,855/t to average US$13,852/t over the same time period.

Impacted Supply

Impacted Supply

The unfavourable environment pumped the breaks on new development with scheduled new mines being pushed further and further down the line.

Project Delays

In its Q2 2024 results, Arcadium Lithium announced plans to reduce its capital spending by around US$500m over the next two years in response to unfavourable market conditions. To do this, Arcadium will be deferring investment in two of the four previously proposed expansion projects, Galaxy and Salar de Hombre Muerto.