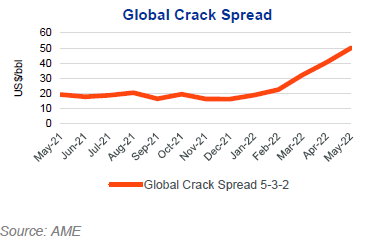

Rapidly

increasing crude oil prices typically reduce product crack spreads, but

lower-than-average inventories are supporting higher crack spread prices.

Despite

high crude oil input costs for refineries, the price of refined products has

risen more than 45% this year, increasing the spread and beefing up the bottom

line for refiners. The crack spread price will remain very high through the

summer driving season as fuel demand peaks. Inventories of critical fuels are

also at near historic lows. Refining profits are

surging globally on fears of a potential gasoil shortage, as buyers avoid

Russian supplies despite soaring feedstock costs elsewhere.

AME

forecasts average prices will decline from US$34/bbl in 2023 to US$23/bbl in

2024, supported by a steady rebound in China’s demand for petrochemicals and

fuels. AME's global 5-3-2 crack spread averaged US$49.9/bbl in May, increasing

by 120% from the February average of US$22.5/bbl.

Refining margins will see

seasonal gains, and the two-year outlook is positive as mobility demand, both

for driving and flying, increases. New capacity additions in 2022 and increased

global runs will outpace the demand growth for refined products, leading to an

unwinding of some of the refinery margin gains from late last year.

Worldwide refiners are struggling to

meet global demand for diesel and gasoline, exacerbating high prices and

aggravating shortages from big consumers like the US and Brazil to smaller

countries like the Ukraine and Sri Lanka.

In May, the Reformulated Blendstock for

Oxygenate Blending (RBOB) gasoline average price was US$160.3/bbl, 39% higher

than February’s average of US$115.0/bbl. The US New York Harbour Ultra Low

Sulphur Diesel (NY ULSD) fuel average price was US$166.3/bbl, a 40% increase

from US$118.7/bbl in February.

Refiners globally are focussed on ESG

outcomes, targeting to lower Scope 1 and Scope 2 emissions. They are aiming to

achieve CO2 reduction through operational efficiency gains, increased

production of renewable fuels such as ethanol and renewable diesel, and CCS

programs. The transition will require significant capital investment and

additional costs. This adds pressure on simple and small refineries and will make

them less competitive in the long run.

Engaging with the energy transition,

Phillips 66's Humber refinery in the UK will integrate CO2 capture technology

with infrastructure to export CO2 into a proposed transport and storage

network. The Humber region produces 40% of the UK’s industrial CO2 emissions.

The project could provide a model for decarbonising refineries and make a

significant impact on the UK’s net-zero ambitions.

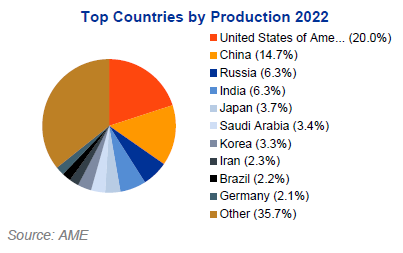

Saudi

Aramco is considering a joint project to build a 300kbpd refining and

petrochemical complex in Northeast China by 2024. The facility will help meet

the country’s growing demand for energy and chemical products.

Marathon is

aiming to reduce Scope 1 and 2 emissions to 30% below 2014 levels achieving

20.9 tonnes of CO2 equivalent per thousand boe by 2030.