Russian coal deliveries to Europe fell by

12% in the first half of 2022, with June shipments falling by 48% on the year.

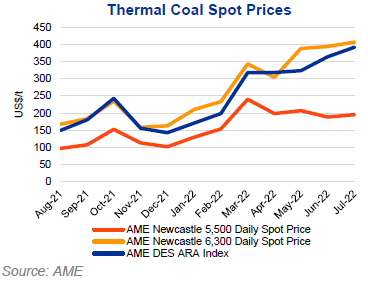

The Newcastle 6,300 spot price will

average US$327/t in 2022, up 139% from the 2021 yearly average of US$137. Coal

prices will remain strong as gas prices in Europe increased after reports that

the pumping capacity of Nord Stream 1 will fall from 40% to about 22% of the

maximum capacity of the pipeline. AME forecasts that thermal coal prices will

fall to US$270 in 2023 and US$200 in 2024 as gas prices ease and coal trade

flows stabilise.

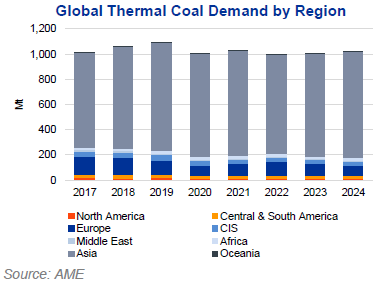

EU nations have agreed to reduce gas

consumption by 15% between August 2022 and March 2023. This will increase coal-fired

generation in the EU, as the region switches to other energy sources.

On the

supply side, Indonesian miners are considering lowering their 2022 targets as

unseasonal rains and shortage of heaving equipment hit production volumes. AME

forecasts a deficit of -15Mt of thermal coal in the market in 2022, a

continuation from the -12Mt deficit seen in 2021.

Global competition for coal is escalating

as power generators attempt to restock inventory levels. Japan’s Nippon Steel agreed

on a supply deal with Glencore for Australian thermal coal at US$375/t. The most

expensive contract ever recorded between the two companies will be valid

through March 2023. This agreement may be used as a benchmark price for other deals

in Asia, although this will further raise the cost of electricity.

Vietnam aims to shelve

over 14GW of future coal capacity from the national power development plan, as

part of its emissions reduction strategy to achieve net zero by 2050. With

energy transition drastically impacting funding in coal projects in Southeast

Asia, the share of coal in Vietnam’s energy mix will drop to 13% by 2045 from

an estimated 31% in 2030.

Vietnam’s electricity demand has surged

at a CAGR of 10% over the last five years. The country has one of the best renewable

resources in Southeast Asia. Hanoi plans to double its wind power capacity

with a US$13bn offshore facility developed by AES Corporation, a US energy

company.

Vietnam currently has about 4GW of wind capacity, which combined with

solar accounts for 27% of the total installed generation capacity in the

country. The government aims to install 11.7GW by 2030 and 66GW by 2045.

Glencore has sold

its 6.4% interest in Yancoal Australia in a deal worth A$422m (US$293m). The transaction

involved the sale of 84.5 million shares traded at A$5 (US$3.57) each. The deal closely follows Glencore’s alleged

rejection of Chinese Yankuang Energy’s offer to buy Glencore’s minority stake. Glencore’s

consolidation of its coal assets will remain unaffected, as the miner did not

consider the shareholding in Yancoal to be a core asset for the business.