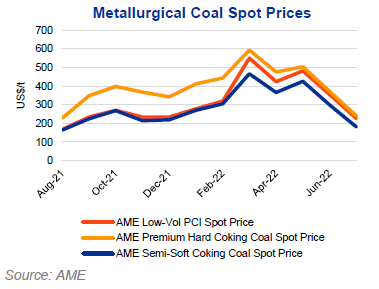

The coking coal price has fallen at a much faster than anticipated, while thermal coal price remained above US$/400/t, as falling steel demand from major importing countries, such as China, cause downward pressure on prices.

As

this momentum continues, AME expects that the premium HCC spot price will be

US$190/t, the semisoft coking coal price will be US$120/t, and the LVPCI spot

price will be US$155/t by 2024.

Domestic

supply issues are also being resolved, with China’s domestic coking coal output

continuing to increase during the year and Mongolian exports ramping up as

border restrictions ease. The Russian coal ban is another factor as China and

India continue to absorb large volume of cheap Russian imports, limiting the

prices in Asia.

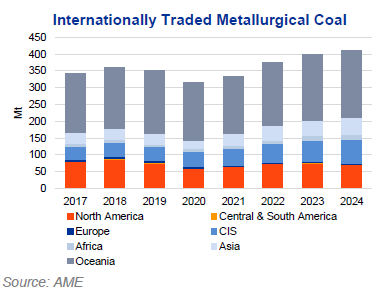

AME

forecasts that metallurgical coal consumption will increase as over next two

years as the war in Ukraine stabilizes or come to a resolution. AME expects

that China will cease its lockdowns. This will drive the growth of

metallurgical coal demand, in the short term.

In

July, the benchmark price for the Australian premium hard coking coal continued

to slip and fell below US$200/t by the end of the month. This is mainly due to

the strong supply response from Australia with the restart of Moranbah North

and declining steel production.

Unlike

thermal coal, new greenfield projects have started to hit the metallurgical

coal market. Although these volumes are small, Bowen coking coal has shipped

its first coal from the new Bluff coal mine and is expected to ramp up the

volume going forward. AME anticipates that these new supplies will continue to

put downward pressure on prices.

The premium HCC FOB Australia price averaged

US$240/t, down from US$372/t the month prior. The standard HCC price decreased

to US$207/t from US$337/t in the previous month. LVPCI averaged US$226/t, down

from US$355/t; and semi-soft decreased considerably to US$181/t from US$299/t.

US low volatile HCC average price fell to US$265/t from US$365/t and the High

Volatile A spot average price fell to US$276/t from US$376/t (down by 20%) in

July.

Australian miner South32 is still looking to

sell its 50% interest in the Eagle Downs metallurgical coal project in

Queensland, Australia. The Eagle Downs project was put on hold in January 2021.

The last Feasibility Study discouraged progress as returns were not in line

with the capital management framework. South32 has recently reported that the

company has not received acceptable offers and is still searching for potential

divestment options.