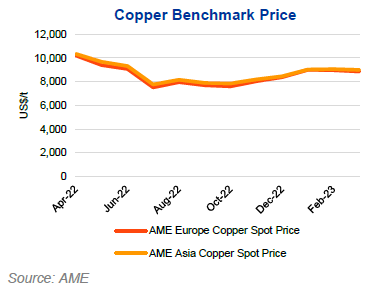

Copper prices traded sideways in the March quarter, averaging US$8,938/t, largely in line with AME’s forecast of US$8,800/t.

AME has slightly revised up its copper

price forecasts for the remaining quarters of 2023 and the full year. AME

forecasts a European copper price of US$9,300/t for the June quarter of 2022,

up from our previous forecast of US$9,100/t. Our forecasts for the September

and December quarters are US$9,600/t and US$9,700/t, respectively, taking the

full year figure to US$9,385/t, up from our previous forecast of US$9,200/t.

This upward revision in prices is based

on the deficit of 491kt forecast for the refined market in 2023, with demand

growth at 4.4% to 27,098kt, exceeding supply growth at 3.8% to 26,607kt. This

growth in demand is primarily on the back of growth from EV production and the

deployment of renewable energy systems.

China's copper smelters purchase team

(CSPT) have set a purchase guide price for copper concentrate TC/RCs for the

June Quarter of 2023 at US$90/t and US¢9.0/lb, marginally down from US$93/t and

US¢9.3/lb in the March quarter. The decrease is due to supply worries caused by

production disruptions related to protests in Peru, new contract negotiations

in Panama and weather events in Indonesia and the DRC.

As recent production disruptions have

eased, AME expects spot TC/RCs in China in the second half of 2023 will remain

above US$90/t and US¢9.0/lb. New mines will continue to ramp up. Meanwhile,

primary smelters' concentrate consumption will largely remain stable, as

several smelters’ expansion projects will start in the second half of 2023 (such

as 80ktpa Yantai Guorun Smelter and 180ktpa Zhongtiaoshan Houma Smelter),

offsetting maintenance-related production disruptions at some primary smelters

(such as Daye, Wuxin, Jinguan, Jiangxi Copper, and Qinghai Copper).

AME’s annual TC/RC forecasts are unchanged.

We forecast the TC/RC to be US$88/t and US¢8.8/lb in 2024, flat at the 2023

level, before declining from 2025, as the copper concentrate market will be in

surplus in 2023 and 2024, before returning to deficit from 2025.

Mergers and acquisitions have emerged as

a key strategy for copper industry players positioning themselves for success

in the net-zero era. Glencore has proposed a US$23bn all-share deal to acquire

Teck Resources, intending to create the world’s fourth largest copper giant and

spin off the combined companies' coal operations into a separate business.

However, Teck has rejected the proposal, citing reluctance to expose its

shareholders to a thermal coal and oil trading business, which goes against the

global decarbonization agenda. Despite this setback, Glencore's bid for Teck

underscores its confidence in the copper outlook and willingness to exit the

coal.

First Quantum will acquire a 55% stake in

the La Granja project in Peru from Rio Tinto for US$105m. Lundin is set to

acquire a 51% interest in Lumina Copper, the operator of the Caserones mine in

Chile, from JX Nippon Mining & Metals for US$950m. Taseko has acquired an

additional 12.5% stake in Canada's Gibraltar Mine from Sojitz for US$44m

increasing its interest to 87.5%.