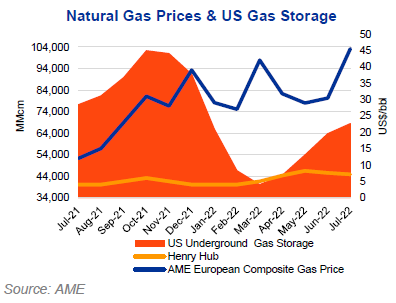

AME forecasts the Henry Hub spot gas price will average US$7.8/MMBtu

in the September quarter. This could rise significantly above forecast levels as

scorching temperatures this summer stoke demand for the fuel of electricity generation.

AME’s European Composite Gas price forecast is US$40.0/MMBtu for

the September quarter. Prices will remain elevated as reduction in supplies

through Nord Stream 1 adds to a series of technical issues at LNG facilities globally

that are exacerbating a supply crisis, while Europe aims to stock up ahead of

winter.

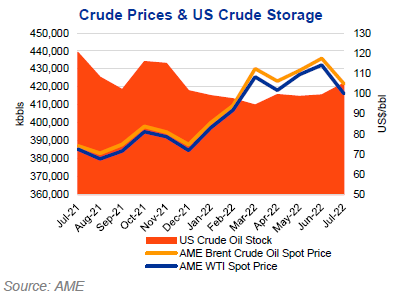

Brent crude oil will average US$111/bbl in the September quarter.

Crude oil prices will slide as recession risks battle scarce supply concerns. WTI

will average US$109/bbl in the September quarter. Softer US demand is weighing

on oil prices, although tight global supplies continue to keep the market

buoyed.

Amid rising US domestic production next year, Henry Hub should

retreat from US$6.8/MMBtu this year to average US$5.7/MMBtu in 2023 and 2024.

The rate of US natural gas production will increase while LNG export and demand

growth slow, contributing to higher storage levels.

AME anticipates that European

gas markets will remain tight with elevated prices in 2022 and 2023-2024. Brent

crude prices will move lower, from US$95/bbl in 2023 to US$86/bbl in 2024 due

to easing global inventory pressures in both markets.

Several key trends will shape market forecasts for the industry

beyond 2022. Populations and economies will grow and will require reliable,

affordable energy. Until fossil fuels are displaced at scale, natural gas and

oil pricing will continue to follow demand growth.

For the natural gas and oil industry, the next few years will

see companies continue to reinvent themselves as they deal with the energy

transition. This will focus on adoption of ESG strategies, capital discipline

and financial health. Debt reduction was 4% in 2021.

Sustainability is becoming a focus

of the oil and gas industry. Companies are steadily committing to climate

change and transforming business models, to include renewable projects as a

greater share of their energy portfolios. Norway plans for a major expansion of

its offshore wind energy production to 30GW by 2040, aiming to turn a country

that has built its wealth on oil and gas into an exporter of renewable

electricity.

More companies are using M&A’s to green existing operations

and strengthen ESG assets. The top country in terms of M&A deals activity

in June 2022 was the US with 26 deals, followed by the China with 11 and Canada

with six.

In 2022, as of June oil and natural gas M&A deals worth US$43.4bn

were announced globally, marking an increase of 41.6% year on year. Global

M&A activity remains well below pre-Covid19 levels as deals need to be both

financially accretive and also support ESG goals. Longer term M&A activity

will tend to increase.