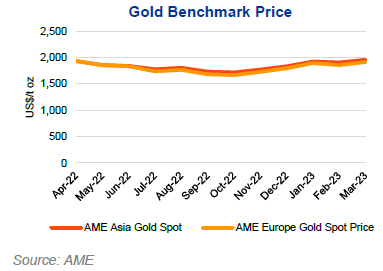

AME’s Asian and European gold prices jumped 9% on-quarter in the March quarter of 2023 to average US$1,932/oz and US$1,889/oz, respectively.

Prices were propelled to US$2,060/oz by

growing safe haven demand amid financial fears following a mini banking crisis and

geopolitical tensions, coupled with expectations of a slowdown in interest rate

hikes. Despite this pricing movement, AME has retained its forecast of

US$1,910/oz for 2023.

Asian gold prices averaged a record

high US$1,958/oz in March, while European prices rose to their highest monthly level

in 11 months to US$1,914/oz, pushed up by lower yields and, to a lesser extent,

a weaker US dollar. Lower bond yields mean less competition for gold, which

produces no income, while an ounce of gold is worth more when the greenback

declines.

Bond yields collapsed in March—the

2-year US Treasury note yield was around 3.9% on Tuesday, down from 5.1% at its

peak early last month. At the same time, bond yields abroad have held up far

better, weighing on the US dollar. That reflects expectations of a looming end

to the Federal Reserve’s rate-boosting cycle amid rising economic headwinds and

turmoil in the banking sector following the demise of Silicon Valley Bank. Higher

prices are fuelling flows into EFTs. March saw gold ETFs net inflows of

US$1.9bn (+32t) for the first time in 10 months. Still, this was not enough to

prevent net quarterly outflows of US$1.5bn (-29t).

AME’s European gold spot price is

forecast to remain robust in the June quarter, averaging US$1,910/oz, as the

Fed’s tightening campaign winds down, while the global economic recovery

remains fragile. The Federal Reserve is expected to

increase interest rates by a quarter-point at the next policy meeting in early

May as it battles stubborn inflation.

Growing financial risks stemming from

unprecedented rate hikes, while stabilised for now, represent upside to gold

prices. The US commercial real estate industry is bracing for trouble as the

midsize banks that service it become more cautious and less willing to lend in

an effort to strengthen their balance sheets after the crisis.

These same factors will push European

gold prices to average US$1,900/z this year, rising 5% from 2022. In 2024, we

expect European gold prices to rise by 5% to US$1,950/oz as monetary policy

eases. Global inflation is expected to fall to 4.3% next year, from 8.8% in

2022.

US

gold major Newmont has raised its offer for Australian rival Newcrest to A$29bn

(US$19.5bn). Newmont launched an

all-share bid for the Australian miner in February. The rejected bid valued the

company at almost US$17bn. Newcrest will open its books to Newmont following

the fresh bid, which would see its shareholders control 31% of its American

rival.

Higher gold prices will likely mean more deals. In

December, Agnico Eagle and Pan American trumped Gold Fields’ offer to buy

Canadian gold producer Yamana for US$4.8bn. Consolidation is also being driven

by higher costs—namely for labour, diesel, and raw materials. South Africa’s Gold Fields

and AngloGold Ashanti said they would combine their Tarkwa and Iduapriem mines

in Ghana to create Africa’s biggest gold mine, partly to reduce costs. Production

would average 900kozpa for the first five years and 600kozpa over the life of

mine.